Mapletree Commercial Trust (MCT) and Mapletree North Asia Commercial Trust (MNACT) merger to form Mapletree Pan Asia Commercial Trust (MPACT)

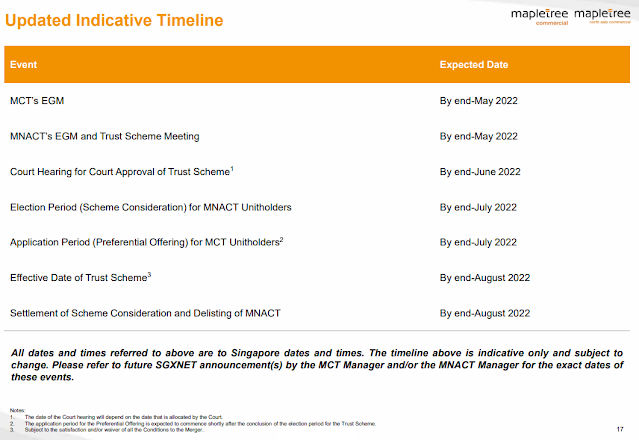

The merger will be done via a trust scheme of arrangement with MCT acquiring all MNACT units in exchange for new units in MCT or a mix of cash and MCT units.

Unitholders of MNACT will receive a scheme consideration of $1.1949 for each unit held as at the record date, bringing the total scheme consideration to $4.215 billion.

The total consideration will comprise of no more than $417.3 million in cash, and the balance amount being in consideration units.

The consideration will be made up of either 0.5963 new MCT units at an issue price of $2.0039 per MNACT unit, or a combination of 0.5009 new units in MCT and 19.12 cents in cash.

The consideration implies a gross exchange ratio of 0.5963 times.

Mapletree North Asia Commercial Trust's (MAPE.SI) unitholders will now have an option to receive consideration in cash from a proposed S$4.2 billion ($3.10 billion) merger with Mapletree Commercial Trust (MACT.SI), the Temasek-linked Singapore real estate investment trusts said on Monday.

Mapletree Commercial Trust (MCT) had announced plans in December to buy Mapletree North Asia Commercial Trust (MNACT), seeking to create the seventh largest real estate investment trust (REIT) in Asia with an expected market value of about S$10.5 billion.

REIT materials on the merger:

MNACT's page on the merger

Joint Announcement - Revision of the Trust Scheme

Joint Presentation - Revision of Trust Scheme and Inclusion of Alternative Cash-Only Consideration

MNACT Presentation - Revision of Trust Scheme and Inclusion of Alternative Cash-Only Consideration

Responses to Frequently Asked Questions

MCT's page on the merger

Joint Announcement - Revision of the Trust Scheme

Joint Presentation - Revision of Trust Scheme and Inclusion of Alternative Cash-Only Consideration

MCT Offers Cash-Only Consideration Alternative to MNACT Unitholders with Full Backing from Mapletree of up to S$2.2 Billion for MCT’s Preferential Offering

Responses to Frequently Asked Questions

Chapter 9/10 - Revision of the terms of the Proposed Merger with Mapletree North Asia Commercial Trust and the Proposed Preferential Offering

MCT Presentation - Revision of Trust Scheme and Inclusion of Alternative Cash-Only Consideration

1) Commentary by Gabriel Yap

2) Commentary by The Astute Parent

3) Commentary from the Fifth Person

4) Never Count on Others

Quarz Capital

1) Quarz opposes Mapletree merger

2) Quarz has setup a website for unitholders opposed to the merger

Comments

Post a Comment