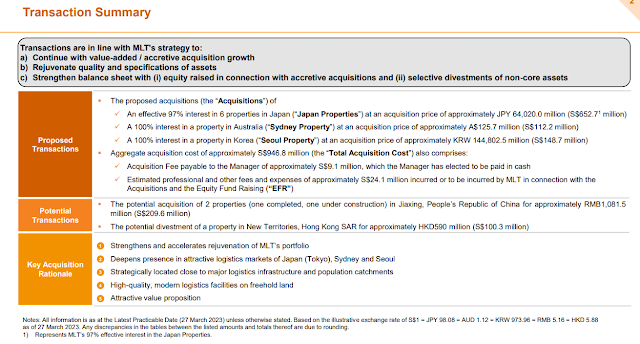

Mapletree Logistics Trust is proposing to acquire 8 logistics assets in Japan, Australia, and South Korea, as well as potentially acquiring 2 logistics assets located in the People's Republic of China. Additionally, there is a potential divestment of a property in Hong Kong SAR. The investor presentation can be found here

Transaction summary:

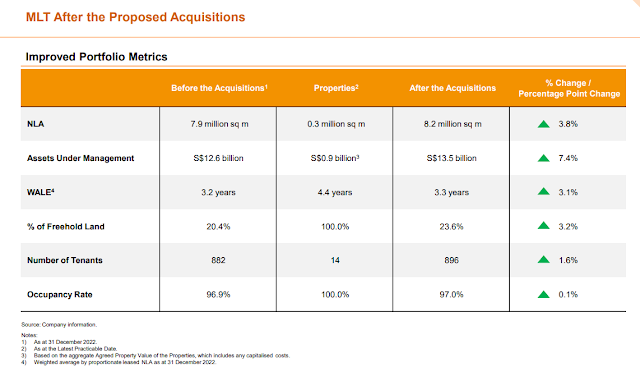

Mapletree Logistics Trust is pursuing these acquisitions and potential divestment as part of its strategy to continue with value-added/accretive acquisition growth, rejuvenate the quality and specifications of assets, and strengthen its balance sheet with equity raised in connection with accretive acquisitions and selective divestments of non-core assets.

The aggregate acquisition cost of the proposed acquisitions is approximately S$946.8 million. This includes the acquisition prices for the individual properties, as well as an acquisition fee payable to the Manager of approximately S$9 million.

This will be funded through a combination of net additional debt and equity. The net additional debt component is expected to be approximately S$746.8 million, while the equity component will be funded through a combination of proceeds from a private placement of new units in Mapletree Logistics Trust (MLT) and internal cash resources.

The pro forma DPU accretion after the acquisitions and equity fund raising (EFR) is expected to be +2.0% for the 9-month financial period ended 31 December 2022,

The information provided on this finance blog is for educational and informational purposes only and should not be construed as financial or investment advice. You should always do your own research and due diligence before making any investment decisions. Any reliance you place on the information provided is strictly at your own risk. I will not be liable for any losses or damages that may arise from your use of the information provided on this blog. Remember, investing involves risks and there is no guarantee that any investment will achieve its objectives or that any investment strategy will be successful. Always consult with a licensed financial professional before making any investment decisions.

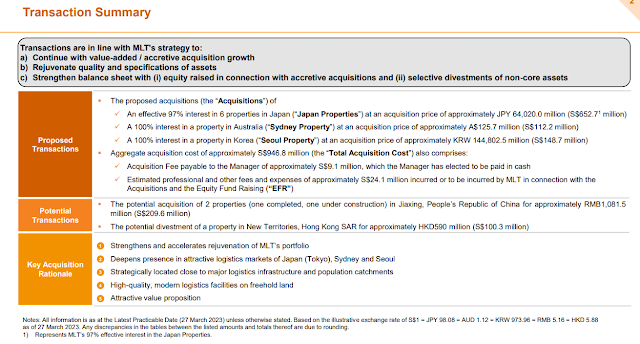

Transaction summary:

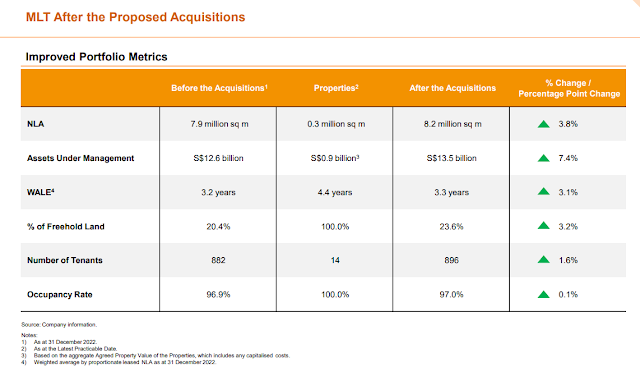

Mapletree Logistics Trust is pursuing these acquisitions and potential divestment as part of its strategy to continue with value-added/accretive acquisition growth, rejuvenate the quality and specifications of assets, and strengthen its balance sheet with equity raised in connection with accretive acquisitions and selective divestments of non-core assets.

The aggregate acquisition cost of the proposed acquisitions is approximately S$946.8 million. This includes the acquisition prices for the individual properties, as well as an acquisition fee payable to the Manager of approximately S$9 million.

This will be funded through a combination of net additional debt and equity. The net additional debt component is expected to be approximately S$746.8 million, while the equity component will be funded through a combination of proceeds from a private placement of new units in Mapletree Logistics Trust (MLT) and internal cash resources.

The pro forma DPU accretion after the acquisitions and equity fund raising (EFR) is expected to be +2.0% for the 9-month financial period ended 31 December 2022,

The information provided on this finance blog is for educational and informational purposes only and should not be construed as financial or investment advice. You should always do your own research and due diligence before making any investment decisions. Any reliance you place on the information provided is strictly at your own risk. I will not be liable for any losses or damages that may arise from your use of the information provided on this blog. Remember, investing involves risks and there is no guarantee that any investment will achieve its objectives or that any investment strategy will be successful. Always consult with a licensed financial professional before making any investment decisions.

Comments

Post a Comment