Mapletree Commercial Trust (MCT) and Mapletree North Asia Commercial Trust (MNACT) merger - Cash offer update

MNACT and MCT announced an update to their offer on 21st March. As per Reuters:

Mapletree North Asia Commercial Trust's (MAPE.SI) unitholders will now have an option to receive consideration in cash from a proposed S$4.2 billion ($3.10 billion) merger with Mapletree Commercial Trust (MACT.SI), the Temasek-linked Singapore real estate investment trusts said on Monday.

Mapletree Commercial Trust (MCT) had announced plans in December to buy Mapletree North Asia Commercial Trust (MNACT), seeking to create the seventh largest real estate investment trust (REIT) in Asia with an expected market value of about S$10.5 billion.

REIT materials on the merger:

MNACT's page on the merger

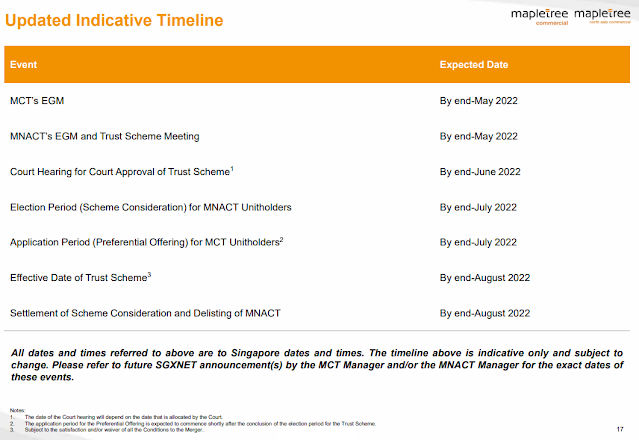

Joint Announcement - Revision of the Trust Scheme

Joint Presentation - Revision of Trust Scheme and Inclusion of Alternative Cash-Only Consideration

MNACT Presentation - Revision of Trust Scheme and Inclusion of Alternative Cash-Only Consideration

Responses to Frequently Asked Questions

MCT's page on the merger

Joint Announcement - Revision of the Trust Scheme

Joint Presentation - Revision of Trust Scheme and Inclusion of Alternative Cash-Only Consideration

MCT Offers Cash-Only Consideration Alternative to MNACT Unitholders with Full Backing from Mapletree of up to S$2.2 Billion for MCT’s Preferential Offering

Responses to Frequently Asked Questions

Chapter 9/10 - Revision of the terms of the Proposed Merger with Mapletree North Asia Commercial Trust and the Proposed Preferential Offering

MCT Presentation - Revision of Trust Scheme and Inclusion of Alternative Cash-Only Consideration

New cash offer

Financial Horse's view on the revised terms

The links above, together with other blogger articles, YouTube videos, company materials and news can be found in the original MNACT and MCT merger post.

None of the above should be construed as investment advice. Do your own due diligence as I will not be responsible for any loss/risk.

Comments

Post a Comment